Yellow Card Legislation and Infringements of Agricultural Aid Rules A Case Study of a Regressive Penalty Structure

Abstract

This article examines the administrative penalty system under the European Union’s Common Agricultural Policy (CAP) in cases of over-declarations of agricultural land. It focuses on the “yellow card” legislation that was introduced in 2016 and applicable until 2022, analysing its practical implications. This “yellow card” system introduced reduced penalties for minor infractions but capped penalties at 100% of the granted aid. This approach can be regressive, as it eliminates additional penalties for irregularities over 50%. As a result, deterrent effects are lessened for serious infractions. Next to a legal analysis of the system, the author uses mathematical analysis to show that irregularities of over 40% do not lead to increased penalties. He argues that the approach followed has encouraged abuses and concludes that the EU should refrain from readopting a sanction system like the “yellow card” in the future.

I. Introduction: Anti-Fraud Rules in CAP Regulations

The Common Agricultural Policy (CAP) is the oldest, most established, and comprehensive of the common European policies. Therefore, substantial expertise has been built in this domain in the context of the anti-fraud framework, given that the initial CAP Regulation was enacted in 1962.1 Indeed, all EU legislation on the CAP established, over decades, a comprehensive system of controls, administrative penalties, and recovery provisions, both at Community and national levels – in accordance with the principle of subsidiarity.

At the Community level, the CAP anti-fraud system has remained broadly the same over the last two decades, with some detailed changes only in the rules on the calculation of penalties in the event of over-declaration. The CAP anti-fraud system is based essentially on the distinction between circumvention, i.e., the situation in which the conditions for obtaining the aid are “artificially created”, and the less serious over-declaration, which occurs when more hectares of land than actually available are included in the single payment application.

This article focuses on the over-declaration sanctioning system, its legislative development, and a comparison between the different legal frameworks regulating it throughout the years. It first presents the main features of tackling fraud patterns in CAP spending (II) and then turns to the penalty systems for CAP fraud in cases of over-declaration, which have been in place over different periods in time and which are compared in view of the penalty calculation (III.). In another step, the penalty system is also analysed from a mathematical point of view (IV.), before conclusions on the lessons for the future are drawn (V.). Based on the analyses, the conclusion is reached that the EU should refrain from adopting a penalty system like the “yellow card” system (2016-2022) again in the future.

II. Tackling Fraud in CAP Spending

The following section features the main provisions of Union law that tackle fraud in CAP spending.

1. The circumvention clause

The circumvention clause is the main anti-fraud rule in the CAP. It is laid down in the EU CAP Regulations and its essence has not changed over the years. It states that no aid is granted to those who “artificially create the conditions” to fulfill eligibility requirements for obtaining the aid. 2 It is an “open” concept and covers a wide range of possible fraud: claimants falsely presenting themselves as farmers, holdings that are non-existent or created only to access European funds, improper claims on agricultural funds by unlicensed applicants, etc. These are (usually) severe infractions with potential criminal repercussions.

2. The rules on over-declaration

Over-declaration (“intentional over-declaration”) refers to irregularities by which a farmer declares more hectares than those actually available to him or her, without a valid right of tenure (ownership, lease, concession, etc.) on the declared land, in order to obtain a higher amount of CAP aid. The legal rules on over-declaration have also remained fairly stable over the years, providing for administrative penalties that are proportional and progressive in relation to the percentage of irregularities detected. This system of “dissuasive and proportionate” administrative penalties is intended to discourage intentional over-declaration.3

From 2005 (the year in which the CAP was “decoupled” from agricultural production, as we know it today) to 2022, the rules on penalties for over-declaration were governed directly by EU regulations and thus uniform in all EU Member States. This included the methods for calculating the penalty. For the 2023-2027 programming period, the approach changed: Regulations (EU) Nos 2115/2021 and 2116/2021 allowed the individual EU Member States to decide on the type and level of administrative penalties to be applied to cases of over-declaration in their national CAP strategic plans. The next section focuses on the CAP administrative penalties for over-declaration and the related mathematical calculation criteria, as set out in the EU regulations. A comparison between the two different systems that were in place in the past will illustrate the Union law concepts of deterrence and the effectiveness of the penalties themselves.

III. Comparison between the Penalty Systems

1. The criteria for calculating penalties for over-declaration in the years 2005-2015

The administrative penalties for the years 2005 to 2015 were governed as follows by Art. 58 of Commission Regulation 1122/20094 and Art. 19 of Commission Delegated Regulation 640/20145:

Over-declaration of up to 3% of the area declared (or two hectares): no administrative penalty, considered a negligible “excess” or “excusable error”;

Over-declaration from 3% to 20% of the area declared: a figure equal to twice that of the overstated hectares is deducted, and the aid is recalculated from the result. In sum: payment with penalty;

Over-declaration from 20% to 50%: no aid granted; all payments are recovered;

Over-declaration of over 50%: all payments are recovered and an additional penalty equal to the amount of aid/support corresponding to the difference between the area declared and the area determined is applied.

The system in force until 2015 could be considered dissuasive, reflecting the idea of effective deterrence combined with an appropriate proportionality balance between penalty and risk. This is particularly evident in the event of significant over-declarations, i.e., declarations of over 50% of the area determined, since a full recovery of the aid payments and an additional penalty is applied.

2. The criteria for calculating the penalty for over-declaration in the years 2016-2022 (“yellow card” Regulation)

Art. 1(7) of Commission Delegated Regulation No 2016/1393 inserted Art. 19a into the Commission Delegated Regulation 640/2014 amending the administrative penalty system on over-declaration for aid applications submitted from 2016 to 2022.6 The method of calculating the administrative penalties in cases of over-declaration was stipulated as follows:

Over-declaration of up to 3% of the area declared (or two hectares): no administrative penalty, considered a negligible “excess” or “excusable error”;

Over-declaration from 3% to 10% of the area declared and if this is the first infringement: the aid/support shall be calculated on the basis of the area determined, reduced by 1,5 times the difference found. If an administrative penalty is imposed, it is reduced by half (50%), but this benefit is lost if a subsequent infringement is committed (“yellow card”);

Over-declaration from 10% to 100% of the area declared: the aid/support shall be calculated on the basis of the area determined, reduced by 1,5 times the difference found. In every case, the administrative penalty shall not exceed 100% of the amounts based on the area declared.

Compared to the rules applicable for applications taken in the period from 2005 to 2015, the introduction of Art. 19a is more advantageous to farmers for the following reasons:

The reduction rate is “only” 1,5 times that of the overstated hectares and no longer 2 times;

A penalty reduced by half applies in minor instances (from 3% to 10% of irregularities) committed for the first and only time (in practice, this means an increase of 0,75 times that of the overstated hectares);

The rule of an additional penalty for irregularities of more than 50% was removed;

A maximum capping of the penalty was set7.

The last two points raise some doubts as to whether the “proportionality and dissuasiveness” of the penalty in this “yellow card” calculation system has been retained, especially if it comes to cases of serious infringement (e.g. more than 50% of irregularities).

Indeed, thanks to the capping of the penalty introduced by the “yellow card” legislation, the maximum risk faced by those who have committed an irregularity of 90% or even 100% is that of having to repay what they have wrongly received. Harsher sanctions are not foreseen. Having removed the additional penalty in the event of an over-declaration of more than 50%, the penalty becomes regressive as the percentage of irregularities increases. The following case examples illustrate this assumption.

Case 1: In 2022, a farmer declared 50 hectares of land (area declared) and obtained a payment of €200 per hectare (in sum: €10.000) but, in reality, he only had 35 hectares available (determined area).

Difference in area declared – area determined (50-35) = 15 (difference found)

15/50 * 100% = 30% (percentage of irregularities)

Irregularity rate > 10% penalty 1,5 times the difference found (15 * 1,5 = 22.5)

The payment should therefore be recalculated, taking into account the area determined (35) minus the difference found (15) * 1.5 (22.5), thus 35 – 22.5 = 12.5

12.5 * 200 (€ per hectare) = €2,500 (corrected sum to be paid)

€10,000 had been paid. €10,000 – €2,500 = €7,500 (sum to be recovered).

Case 2: In 2022, a farmer declared 50 hectares of land (area declared) and obtained a payment of €200 per hectare (in sum: €10,000) but, in reality, he only had 24 hectares available (determined area).

Difference in area declared – area determined (50 – 24) = 26 (difference found)

26/50 * 100% = 52% (percentage of irregularities)

Irregularity rate > 10% penalty 1,5 times the difference found (26 * 1,5 = 39)

The payment should therefore be recalculated, taking into account the area determined (24) minus the difference found (26) * 1.5 (39), thus 24 – 39 = –15

Negative numbers cannot be applied, because it is impossible to remove more hectares of the total determined area, to exceed 100% of the penalty, and to apply an additional penalty for infringements > 50%.

Despite the size of the irregularity (52%), the maximum penalty applicable will therefore only be the complete rescindment of the aid granted.

Case 3: In 2022, a farmer declared 50 hectares (area declared) and obtained a payment of €200 per hectare (in sum: €10,000) but, in reality, he only had 5 hectares available (determined area).

Difference in area declared – area determined (50 – 5) = 45 (difference found)

45/5 * 100% = 90% (percentage of irregularities)

Irregularity rate > 10% penalty 1,5 times the difference found (45 * 1,5 = 67.5)

The payment should therefore be recalculated, taking into account the area determined (5) minus the difference found (45) * 1.5 (67.5), 5 – 67.5 = –62.5

However, negative numbers cannot be applied because it is impossible to remove more hectares of the total determined area, namely to exceed 100% of the penalty and thus apply an additional penalty for infringements > 50%.

Despite the size of the irregularity (90%), the maximum penalty applicable will therefore only be the complete rescindment of the aid granted, as in the (previous and less serious) case no 2.

3. Comparison between the two different sanctioning systems for over-declaration

The following table shows the difference between the penalty calculated under Art. 19 (for direct aid applications for the years 2005-2015) and the penalty calculated under the commonly known “yellow card” concept under Art. 19a (for direct aid applications for the years 2016-2022). The table presents various instances of over-declaration irregularities, ranging from 2% to 100%, taking up the above-mentioned basic case examples, i.e., area declared of 50 hectares and payment of €200/hectare (in sum: €10,000). The columns to the right show the differences in the calculation of the administrative sanctions under the two presented sanction systems in place between 2005-2015, on the one hand, and between 2016-2022, on the other.

Table 1: Comparison of Penalty Calculations under Art. 19 and Art. 19a (2005-2015 vs. 2016-2022)

| Payment EUR/Ha | Area declared (D) | Granted amount | Area determined (X) | Difference Y (D-X) | Irregularity | Sanction (S) (Art. 19) 2005-2015 | Sanction (S) (Art. 19a) 2016-2022 "yellow card" |

|---|---|---|---|---|---|---|---|

| €200,00 | 50 | €10.000,00 | 49 | 1 | 2% | € – | € – |

| €200,00 | 50 | €10.000,00 | 48 | 2 | 4% | €800,00 | €500,00 |

| €200,00 | 50 | €10.000,00 | 47 | 3 | 6% | €1.200,00 | €750,00 |

| €200,00 | 50 | €10.000,00 | 46 | 4 | 8% | €1.600,00 | €1.000,00 |

| €200,00 | 50 | €10.000,00 | 45 | 5 | 10% | €2.000,00 | €2.500,00 |

| €200,00 | 50 | €10.000,00 | 44 | 6 | 12% | €2.400,00 | €3.000,00 |

| €200,00 | 50 | €10.000,00 | 43 | 7 | 14% | €2.800,00 | €3.500,00 |

| €200,00 | 50 | €10.000,00 | 42 | 8 | 16% | €3.200,00 | €4.000,00 |

| €200,00 | 50 | €10.000,00 | 41 | 9 | 18% | €3.600,00 | €4.500,00 |

| €200,00 | 50 | €10.000,00 | 40 | 10 | 20% | €4.000,00 | €5.000,00 |

| €200,00 | 50 | €10.000,00 | 39 | 11 | 22% | €10.000,00 | €5.500,00 |

| €200,00 | 50 | €10.000,00 | 38 | 12 | 24% | €10.000,00 | €6.000,00 |

| €200,00 | 50 | €10.000,00 | 37 | 13 | 26% | €10.000,00 | €6.500,00 |

| €200,00 | 50 | €10.000,00 | 36 | 14 | 28% | €10.000,00 | €7.000,00 |

| €200,00 | 50 | €10.000,00 | 35 | 15 | 30% | €10.000,00 | €7.500,00 |

| €200,00 | 50 | €10.000,00 | 34 | 16 | 32% | €10.000,00 | €8.000,00 |

| €200,00 | 50 | €10.000,00 | 33 | 17 | 34% | €10.000,00 | €8.500,00 |

| €200,00 | 50 | €10.000,00 | 32 | 18 | 36% | €10.000,00 | €9.000,00 |

| €200,00 | 50 | €10.000,00 | 31 | 19 | 38% | €10.000,00 | €9.500,00 |

| €200,00 | 50 | €10.000,00 | 30 | 20 | 40% | €10.000,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 29 | 21 | 42% | €10.000,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 28 | 22 | 44% | €10.000,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 27 | 23 | 46% | €10.000,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 26 | 24 | 48% | €10.000,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 25 | 25 | 50% | €10.000,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 24 | 26 | 52% | €15.200,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 23 | 27 | 54% | €15.400,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 22 | 28 | 56% | €15.600,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 21 | 29 | 58% | €15.800,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 20 | 30 | 60% | €16.000,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 19 | 31 | 62% | €16.200,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 18 | 32 | 64% | €16.400,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 17 | 33 | 66% | €16.600,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 16 | 34 | 68% | €16.800,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 15 | 35 | 70% | €17.000,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 14 | 36 | 72% | €17.200,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 13 | 37 | 74% | €17.400,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 12 | 38 | 76% | €17.600,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 11 | 39 | 78% | €17.800,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 10 | 40 | 80% | €18.000,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 9 | 41 | 82% | €18.200,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 8 | 42 | 84% | €18.400,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 7 | 43 | 86% | €18.600,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 6 | 44 | 88% | €18.800,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 5 | 45 | 90% | €19.000,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 4 | 46 | 92% | €19.200,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 3 | 47 | 94% | €19.400,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 2 | 48 | 96% | €19.600,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 1 | 49 | 98% | €19.800,00 | €10.000,00 |

| €200,00 | 50 | €10.000,00 | 0 | 50 | 100% | €20.000,00 | €10.000,00 |

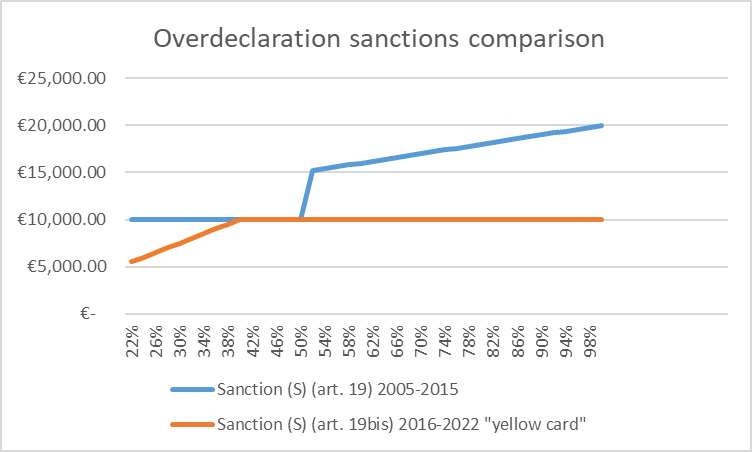

The following figure illustrates a graphic comparison of the two sanctioning systems under Art. 19 and Art. 19a8 ('yellow card'): the 'flattening' of the penalty is highlighted, starting at 40% irregularity in the 'yellow card' system. In the other sanctioning system, however, the penalty increases with the level of irregularity, thus demonstrating greater proportionality.

Figure 1: Comparison of over-declaration sanctions under Art. 19 and Art. 19a (2005-2015 vs. 2016-2022)

IV. Mathematical Analysis of Penalties According to the “Yellow Card” Legislation

Art.19a of the amended Commission Delegated Regulation 640/2014 (applicable for claims from 2016 to 2022, “yellow card”) lays down the following rule:

If, in respect of a crop group […] the area declared (D) […] exceeds the area determined (X) […], the aid or support shall be calculated on the basis of the area determined reduced by 1,5 times the difference found (Y) if that difference is more than either 3% of the area determined or 2 hectares.9

The administrative penalty (S) shall not exceed 100% of the amounts calculated on the basis of the area declared.

The above rule can be translated into a mathematical formula as follows:

1. Definitions:

— D: area declared

— X: area determined

— Y: difference between area declared and area determined, i.e., Y = D – X

— S: administrative penalty

2. Formula:

— If D > X, the penalty (S) is calculated as:

whereby:

— (1.5 * Y) is the reduction of the difference.

— The penalty (S) cannot exceed 100% of the amount calculated on the area declared, so we have to take the minimum (min) between the calculated amount and 100% of the area declared.

In summary:

Continuing the mathematical reasoning, we analyse the penalty formula to identify the threshold of irregularities below which the penalty remains zero, and to determine the conditions under which it vanishes.

Penalty S shall be calculated as:

Whereby:

D: area declared

X: area determined

Y: difference between the area declared and the area determined, i.e., Y = D − X.

The penalty will be zero if the difference between the area declared and the area determined is such that the expression X − (1,5 × Y) equals zero or becomes negative. In other words, we need to identify the situation where the difference between D and X is sufficiently small to cause the calculated penalty (according to the formula) to be zero or even negative.

To proceed, we assume:

Replacing Y = D − X yields:

Distributing 1.5 within parenthesis yields:

Combining the terms with X yields:

Dividing both sides by 2,5, we obtain:

Therefore, the penalty is zero when the area determined X is 60% of the area declared D. If the area determined is 60%;10 this implies an irregularity of 40% at the time of declaration. Consequently, for irregularities ranging from 40% to 100%, no penalty will be imposed; instead, only full recovery of the amount paid will apply.

V. Conclusions

This article compared the systems of administrative penalties for over-declarations in CAP aid applicable in the period 2005-2015 (Art. 19 of Commission Delegated Regulation 640/2014) on the one hand, and the period from 2016-2022 (Art. 19a of Commission Delegated Regulation 640/2014 as introduced by Commission Delegated Regulation 2016/1393) on the other. It illustrated that, under the new approach introduced by Art. 19a, the impact of administrative penalties has remained constant as the percentage of irregularities increases. This in turn results in a regressive penalty structure. By capping the reduction at a maximum threshold beyond which no further penalties can be imposed, and eliminating additional penalties for major infringements when irregularities exceed 50%, the regressive effect is further corroborated compared to previous rules. Case examples and mathematical calculations demonstrated that, under the legislation in force from 2016-2022, penalties do not escalate beyond an irregularity threshold of 40%. This leads to an identical treatment for applications with 40% irregularities and those with 100%, highlighting the regressive nature of the penalty structure.

In practice, this penalty structure has offered minimal deterrence: it statistically incentivized more serious irregularities, because CAP applicants could receive higher aid while facing penalties equivalent to those for minor infractions – effectively risking only the repayment of unlawfully obtained funds, with no additional repercussions.

The results of this analysis yield a clear recommendation for the future: neither the EU nor its Member States – which regained authority over sanctioning systems for CAP irregularities in 202311 – should reinstate the “yellow card” system used for over-declarations that had been in place between 2016 and 2022. This suggests that future sanctioning systems for over-declarations must be based on a more balanced and proportionate penalty framework: a lesson from the past, to build a fairer future.

Regulation No 25 on the financing of the common agricultural policy, OJ 30, 20.4.1962, pp. 991 – 993.↩︎

Cf. the circumvention clauses in Art. 30 of Regulation 73/2009, OJ L 30, 31.1.2009, 16 (in force for aid applications from 2009 to 2014); Art. 60 of Regulation 1306/2013, OJ L 347, 20.12.2013, 549 (in force for aid applications from 2015 to 2022); and Art. 62 of Regulation 2021/2116, OJ L 435, 6.12.2021, 187 (in force for aid applications from 2023 to 2027).↩︎

See Recital 27 of Commission Delegated Regulation (EU) No 640/2014 of 11 March 2014 supplementing Regulation (EU) No 1306/2013 of the European Parliament and of the Council with regard to the integrated administration and control system and conditions for refusal or withdrawal of payments and administrative penalties applicable to direct payments, rural development support and cross compliance, OJ L 181, 20.6.2014, 48.↩︎

Art. 58 of Commission Regulation (EC) No 1122/2009 of 30 November 2009 laying down detailed rules for the implementation of Council Regulation (EC) No 73/2009 as regards cross-compliance, modulation and the integrated administration and control system, under the direct support schemes for farmers provided for that Regulation, as well as for the implementation of Council Regulation (EC) No 1234/2007 as regards cross-compliance under the support scheme provided for the wine sector, OJ L 316, 2.12.2009, 65, reads as follows (emphasis added by author):

↩︎If, in respect of a crop group, the area declared for the purposes of any area-related aid schemes, except those for starch potato and seed as provided for in Sections 1 and 2 of Chapter 5 of Title IV of Regulation (EC) No 73/2009, exceeds the area determined in accordance with Article 57 of this Regulation, the aid shall be calculated on the basis of the area determined reduced by twice the difference found if that difference is more than either 3% or two hectares, but no more than 20% of the area determined.

If the difference is more than 20% of the area determined, no area-linked aid shall be granted for the crop group concerned.

If the difference is more than 50%, the farmer shall be excluded once again from receiving aid up to an amount equal to the amount which corresponds to the difference between the area declared and the area determined in accordance with Article 57 of this Regulation.

This amount shall be off-set from payments in accordance with Article 5b of Commission Regulation (EC) No 885/2006. If the amount cannot be fully off-set in accordance with that article in the course of the three calendar years following the calendar year of the finding, the outstanding balance shall be cancelled.

Art. 19 of Commission Delegated Regulation 640/2014, op. cit. (n. 3), (applicable for applications until the year 2015) reads as follows (emphasis added by author):

↩︎1. If, in respect of a crop group as referred to in Article 17(1), the area declared for the purposes of any area-related aid schemes or support measures exceeds the area determined in accordance with Article 18, the aid shall be calculated on the basis of the area determined reduced by twice the difference found if that difference is more than either 3% or two hectares, but no more than 20% of the area determined.

If the difference is more than 20% of the area determined, no area-related aid or support shall be granted for the crop group concerned.

2. If the difference is more than 50%, no area-related aid or support shall be granted for the crop group concerned. Moreover, the beneficiary shall be subject to an additional penalty equal to the amount of aid or support corresponding to the difference between the area declared and the area determined in accordance with Article 18.

3. If the amount calculated in accordance with paragraphs 1 and 2 cannot be fully off-set in the course of the three calendar years following the calendar year of the finding, in accordance with the rules laid down by the Commission on the basis of Article 57(2) of Regulation (EU) No 1306/2013, the outstanding balance shall be cancelled.

Art. 19a inserted by Commission Delegated Regulation (EU) 2016/1393 of 4 May 2016 amending Delegated Regulation (EU) No 640/2014 supplementing Regulation (EU) No 1306/2013 of the European Parliament and of the Council with regard to the integrated administration and control system and conditions for refusal or withdrawal of payments and administrative penalties applicable to direct payments, rural development support and cross compliance, OJ L 225, 19.8.2016, 41, reads as follows:

↩︎1. If, in respect of a crop group as referred to in Article 17(1), the area declared for the aid schemes provided for in Chapters 1, 2, 4 and 5 of Title III and in Title V of Regulation (EU) No 1307/2013 and the support measures referred to in Articles 30 and 31 of Regulation (EU) No 1305/2013 exceeds the area determined in accordance with Article 18 of this Regulation, the aid or support shall be calculated on the basis of the area determined reduced by 1,5 times the difference found if that difference is more than either 3% of the area determined or 2 hectares.

The administrative penalty shall not exceed 100% of the amounts based on the area declared.

2. Where no administrative penalty has been imposed on the beneficiary under paragraph 1 for over-declaration of areas for the aid scheme or support measure concerned, the administrative penalty referred to in that paragraph shall be reduced by 50% if the difference between the area declared and the area determined does not exceed 10% of the area determined.

3. Where a beneficiary had his administrative penalty reduced in accordance with paragraph 2 and another administrative penalty as referred to in this Article and in Article 21 is to be imposed on that beneficiary for the aid scheme or support measure concerned in respect of the following claim year, he shall pay the full administrative penalty in respect of that following claim year and shall pay the amount by which the administrative penalty calculated in accordance with paragraph 1 had been reduced in accordance with paragraph 2.

4. If the amount calculated in accordance with paragraphs 1, 2 and 3 cannot be fully off-set in the course of the three calendar years following the calendar year of the finding, in accordance with Article 28 of Implementing Regulation (EU) No 908/2014, the outstanding balance shall be cancelled.’;

Art. 19a(1) subpara. 1 of the amended Commission Delegated Regulation 640/2014, op. cit. (n. 6).↩︎

In the Italian version “Art. 19 bis”.↩︎

See the wording in note 6 supra.↩︎

This is expressed by the following formula: .↩︎

See above I.↩︎

The views expressed in this article are exclusively those of the author and do not necessarily reflect the official opinion of the institution that employs him.